May 9th Recap as well as May 10th Predictions

What to Expect in Today’s Dow Jones Analysis

With the sixth trading day of May complete, let us see how the day unfolded and what to expect tomorrow.

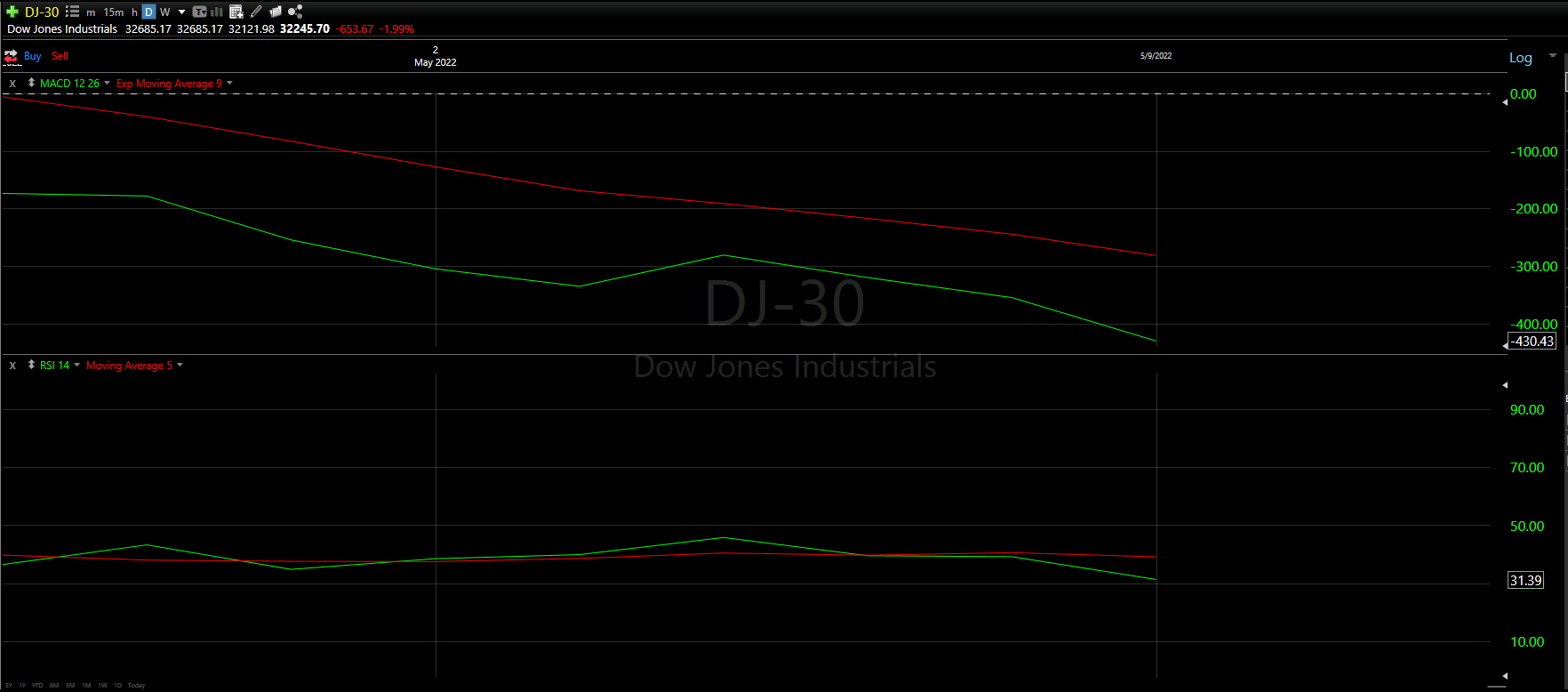

Above you will see the full view of the Daily chart, Top and Bottom Half indicators included.

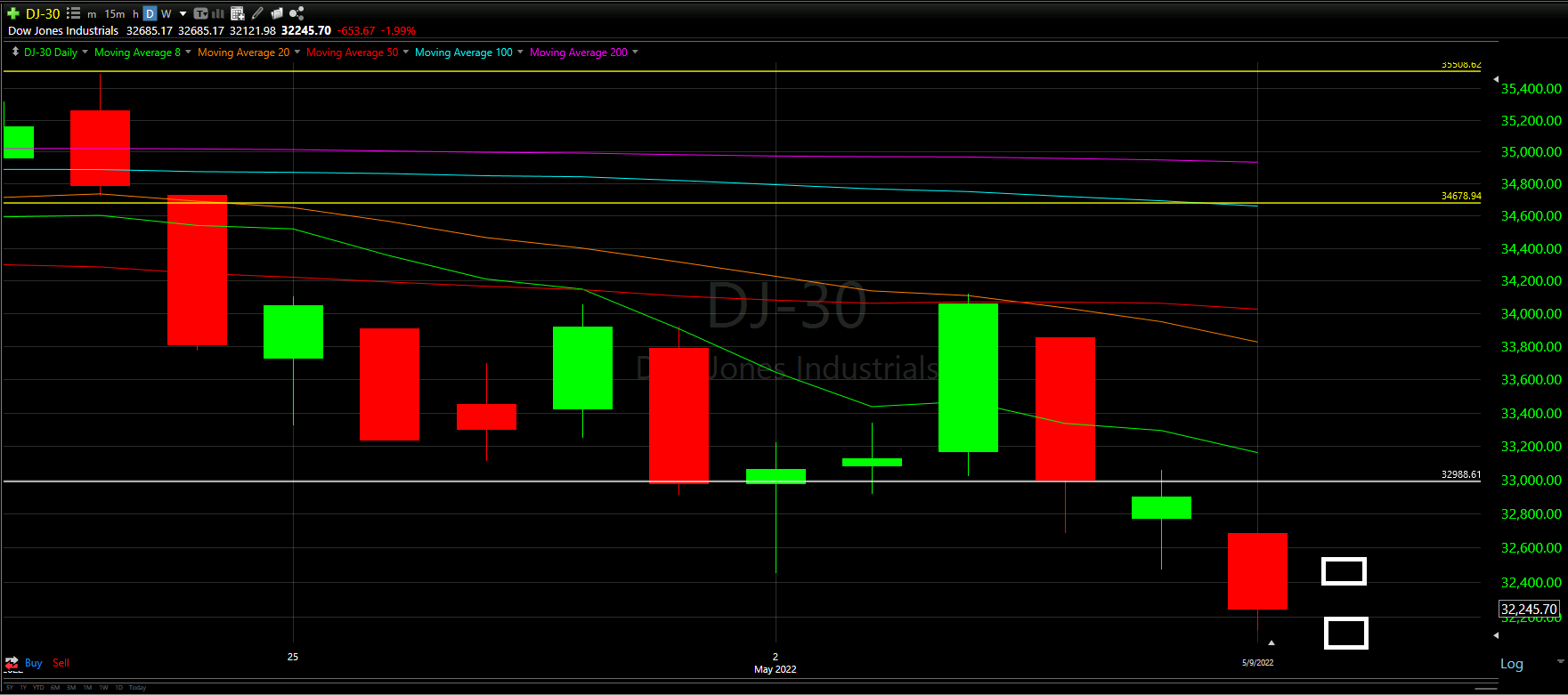

As always, we will start by analyzing the Top Half of the Daily chart; seeing how our horizontal Support and Resistance Lines played out during the day, reviewing the Moving Averages that came into play as well as comparing previous candles.

From there, we will analyze the Bottom Half of the Daily chart to see what the momentum looks like going into tomorrow with the additional MACD and RSI indicators.

Ultimately, we will use the combined data to help predict the movement of the Dow Jones for tomorrow.

Top Half Analysis

There is absolutely nothing positive in the Top Half Analysis!

To start, the Dow Jones has lost - and sustained the loss - of the roughly $32.9k support line. With no immediate support line around, this drop could be pretty bad.

All the Moving Average lines are now lost, as we continue to trade well below the 8MA. That miracle 4 trading days ago seems like nothing more than an outlier at this point.

We may need to start zooming out more for tomorrow’s chart to really understand what the fall looks like.

Not Good, to say the least…

Bottom Half Analysis

The goal of the Bottom Half analysis is to see a similar story between the MACD and RSI indicators. Ideally both are doing the thing, adding to the confidence of the readings.

Unfortunately, today, the MACD and RSI indicators are aligned… and it does not seem to be positive at all…

Starting with the MACD, clearly the green line is well below the red with a hard decline still seeming realistic. There is not even a slight hint at an upward curve on the green line.

The RSI seems to have officially lost the battle between green and red, with the green line starting to sharply diverge from the red line.

The combined indications of Red lines over Green lines across the MACD and RSI is horrible.

…these 3%+ losses are not finished yet.

Hourly Analysis

Here we see how the 8MA really dictated how the hourly chart was going to move.

Despite the strong close on Friday’s hourly, this morning’s trading started below 50% yesterday’s green candle as well as under the 8MA. Individually those are bad, but combined really would have been a telling sign that the day was in trouble.

The second hour was pretty much a bloodbath with no wicks at all. The hour was a straight loss for 60 minutes.

Hours 3 to 6 started to show some promise, with the 6th hour closing above 50% the bloodbath candle at the 2nd hour. However, the 8MA was not ready to crack, and became a Resistance line too difficult to break.

The MACD and RSI indicators really show nothing positive either, as both have the red lines over the green lines.

Rough Hourly Chart indeed!

Final Thoughts and Targets

With the closest support line a distant memory, it seems the Dow Jones will be in trouble tomorrow.

Best case scenario would be the day is positive and is able to close at or above 50% of today’s candle.

All the Majors are trading well below the 8 Moving Average so that needs to change.

However, all signs really are pointing to more bad days.

Good luck trading!

Don’t forget to check out the Free Knowledge Center to refresh the basics or learn more about Technical or Fundamental Analysis