May 5th Recap as well as May 6th Predictions

What to Expect in Today’s NASDAQ Analysis

With the fourth trading day of May completed, let us see how the day unfolded and what to expect tomorrow.

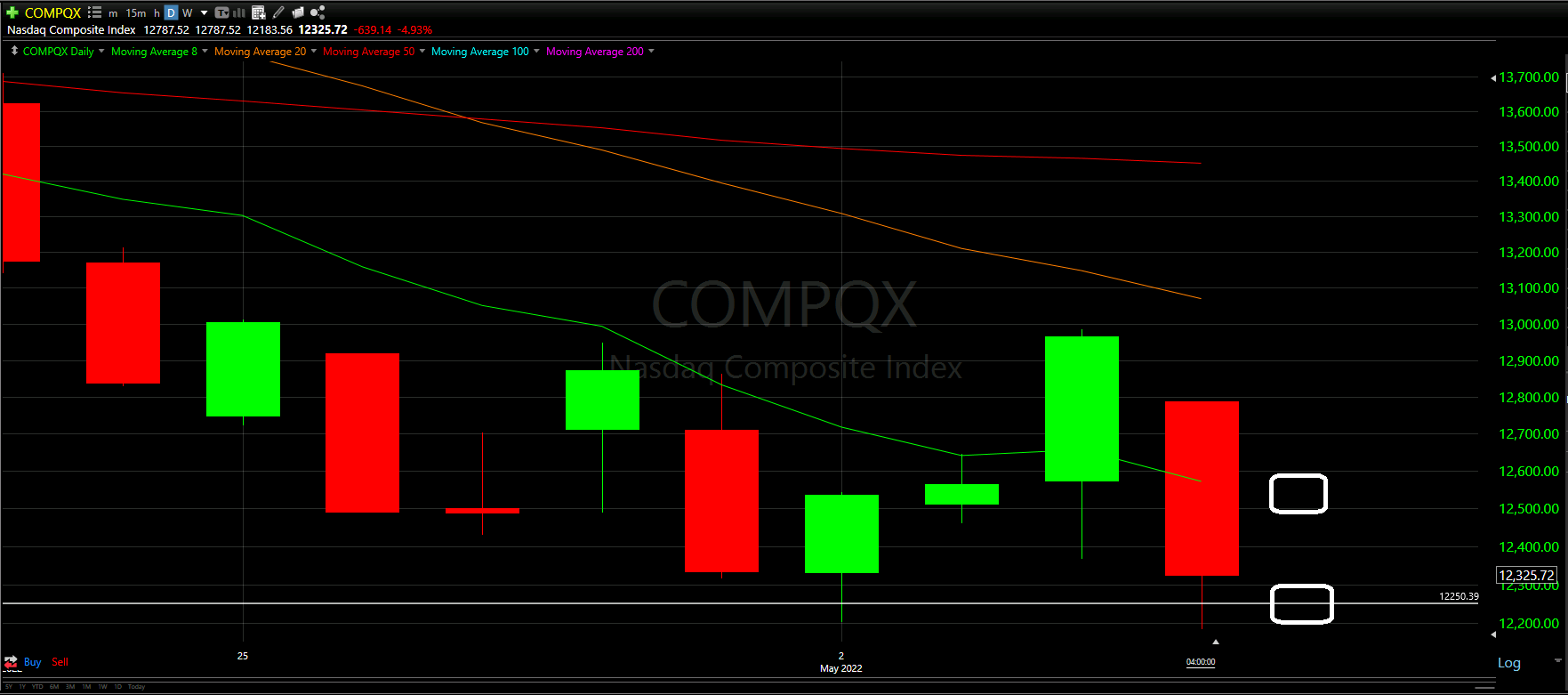

Above you will see the full view of the Daily chart; Top and Bottom indicators included.

As always, we will start by analyzing the Top Half of the Daily chart; seeing how our horizontal Support and Resistance Lines played out during the day, reviewing the Moving Averages that came into play as well as comparing previous candles.

From there, we will analyze the Bottom Half of the Daily chart to see what the momentum looks like going into tomorrow with the additional MACD and RSI indicators.

Ultimately, we will use the combined data to help anticipate the movement of the NASDAQ for tomorrow.

Top Half Analysis

Yesterday’s predictions stressed the importance of keeping some fear and caution despite the 3-green-days in a row.

Today we clearly see why!

In one day, the deep red loses took away days of gains for many; however, The Chart Readers hope you were able to trade with a plan instead of being blindsided like most.

Though yesterday was the first time the NASDAQ closed above the 8 Moving Average line in green, the key was seeing if we could sustain the victory. With the looming combination of the 20 Moving Average and 50 Moving Average lines just above, simply maintaining the 8MA line way key.

But just like that, we lose both 50% of yesterday’s green candle as well as the 8MA! Ouch! Roughly speaking we opened at roughly 50% yesterday’s candle as well so that was a clear sign that bad things were going to happen today…

More so, we are back near our Support Line in white. This was able to cushion the drop, but it seems that was a temporary solution to this continual downtrend the NASDAQ Composite is in.

If we lose (close under) the Support line around $12.2k, we more than likely drop to the next Support line down…

Unless there is some optimistic hope in the Bottom Half Analysis, losing 50% of yesterday’s green candle as well as the 8MA was a deadly blow to this minor 3-day bounce.

Bottom Half Analysis

The goal of the Bottom Half analysis is to see a similar story between the MACD and RSI indicators. Ideally both are doing the thing, adding to the confidence of the readings.

Unfortunately, today, the MACD and RSI indicators are aligned… and it does not seem to be positive at all…

First the first time in a few trading days, the MACD and RSI indicators both show the green line under the red line. Clearly the MACD is a harder divergence; however, both are now showing the same negative signal.

The numbers to the right of both indicators are rarely commented on (the lines themselves matter more); however, it should be noted that the MACD is sitting a -333.36 and still showing signs that it wants to go lower.

As quickly as yesterday’s excitement came, today’s Bottom Half analysis destroyed most of the remaining hope of a continued bounce upward.

Hourly Analysis

The first 3 hours of the trading day were devastating to say the least.

All the Hourly Moving Average lines we closed above yesterday were lost today! We are now under all in this Hourly view.

The NASDAQ almost lost the support line of $12.5k mentioned above; however, it was able to close just above on the last hour despite that very long downward wick. That last hour would be interesting to view in a 20minute or 5minute chart view to see the wick form and recover.

The MACD is still lagging, but there seems to be a nice upward curve forming on the RSI indicator. It is hard to see but the green line is peaking above the red on the RSI

However, that “death cluster” of Moving Average lines around the $12.5k range seem far too difficult to break.

Final Thoughts and Targets

By doing both of yesterday’s worst things possible, the NASDAQ is back into the hard downtrend for now.

With the immediate Support Line not too far away, more than likely, the NASDAQ loses support drops to roughly 50% of the long wick from 4-days ago (and today).

The best outcome for tomorrow would be to climb back up and recapture (close above) the 8 Moving Average line.

Fear and caution should be at the forefront of the mind!

Good luck trading!

Don’t forget to check out the Free Knowledge Center to refresh the basics or learn more about Technical or Fundamental Analysis