January 12th recap and 13th Predictions

What to Expect in the Analysis Below

With the eight trading day of January completed, let us see how the day played out and what to expect tomorrow.

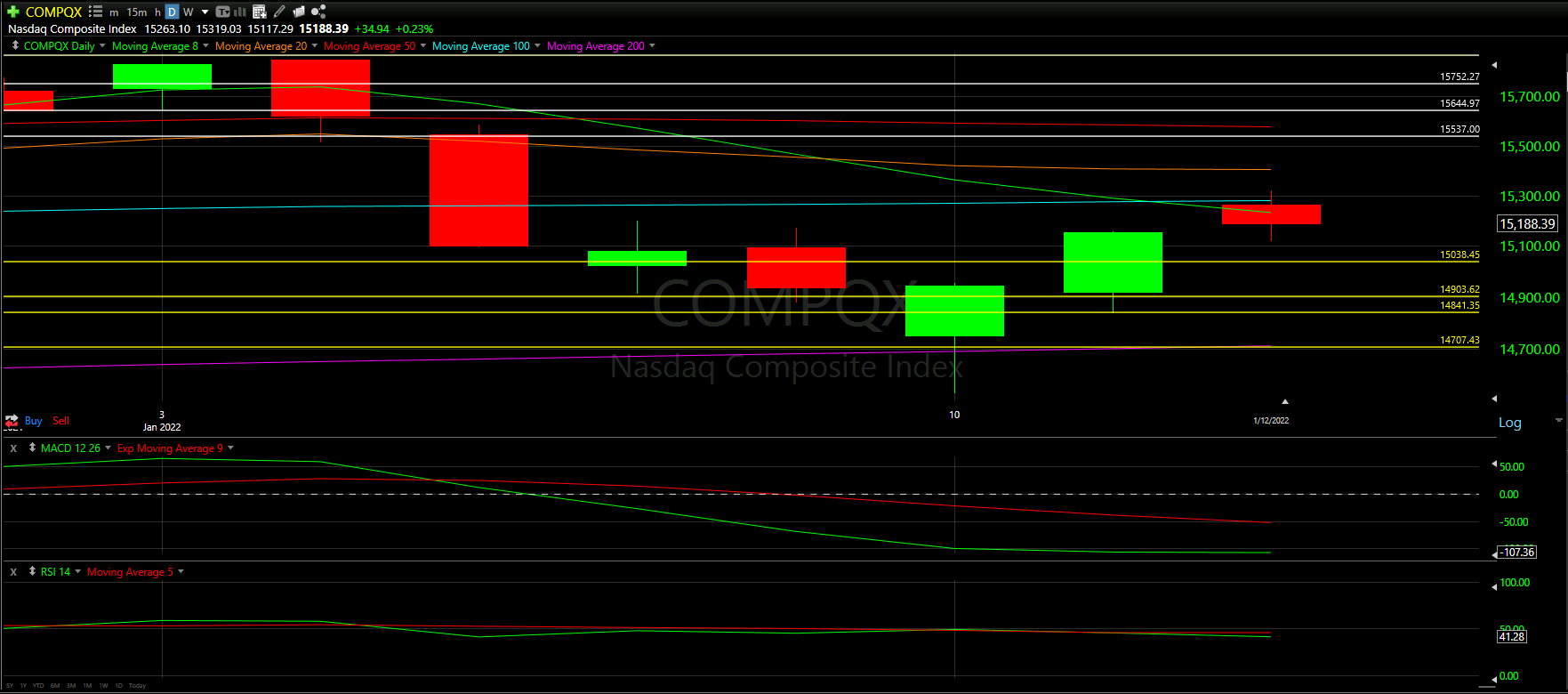

Above you will see the full view of the Daily chart; Top and Bottom indicators included.

As always, we will start by analyzing the Top Half of the Daily chart; seeing how our horizontal Support and Resistance Lines played out during the day, reviewing the Moving Averages that came into play as well as comparing previous candles.

From there, we will analyze the Bottom Half of the Daily chart to see what the momentum looks like going into tomorrow with the additional MACD and RSI indicators.

Ultimately, we will use the combined data to help anticipate the movement of the NASDAQ for tomorrow.

Top Half Analysis

As we wanted to see in yesterday’s predictions, today’s daily candle was able to climb up from the lower cluster of Support lines.

It now looks like the cluster of Moving Averages is starting to come into play. As mentioned, it is hard getting over a single let alone two or more.

The day started over the 8 Moving Average but under the 100 Moving Average. Unfortunately, the 100 Moving Average was never surpassed and drove down the day below the 8 Moving Average line by the close of trading.

Similar to the S&P-500 analysis, there seems to be a dreidel-looking candle, with even-sized wicks on the top and bottom of the candle. This is always a sign of uncertainty.

As stated yesterday, one more day will help confirm what is about to play out. The NASDAQ does seem a bit more worrisome than the S&P-500 mainly due to the failed overpassing of the 8 Moving Average.

Bottom Half Analysis

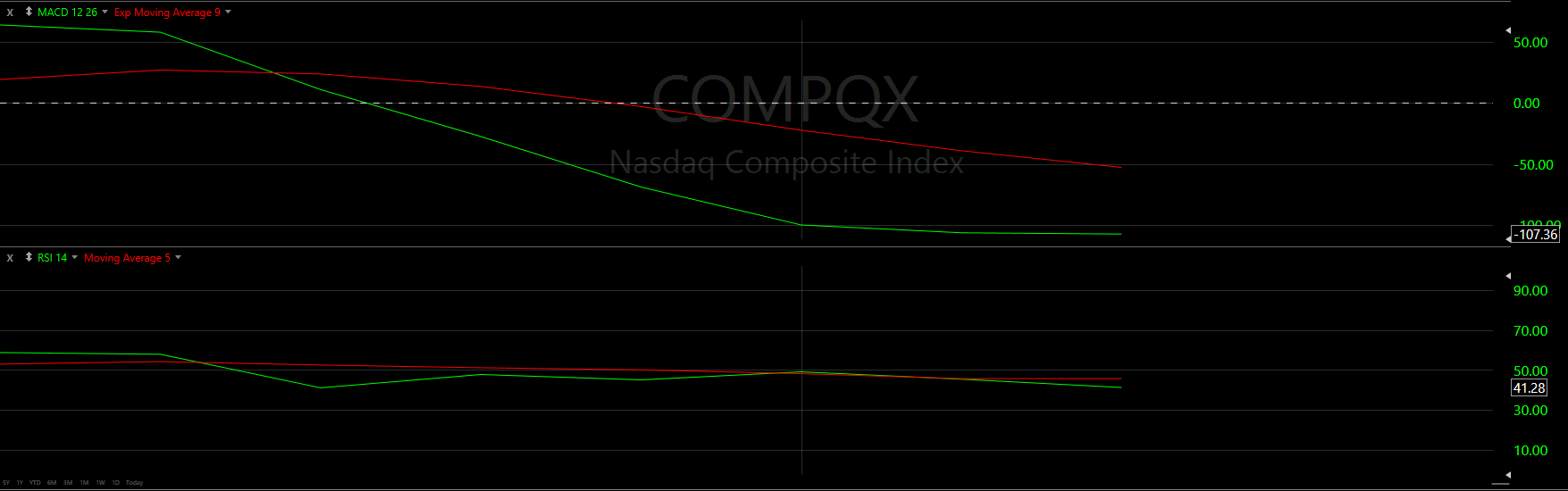

For a second day we continue to see the same discrepancy between the MACD and RSI lines.

The MACD still appears to show the Green line starting a curl up, with hopes of surpassing the Red line in the coming days. The Green line is somewhat flat instead of upward in slope, but at least we did not see a wild crash down.

The RSI; however, is trending down though the last days have been positive. We have echoed the potential worry this shows because it may be difficult to keep an upward trend with low momentum from the RSI.

None the less, let us hope the MACD is the indicator that matters more here for another day!

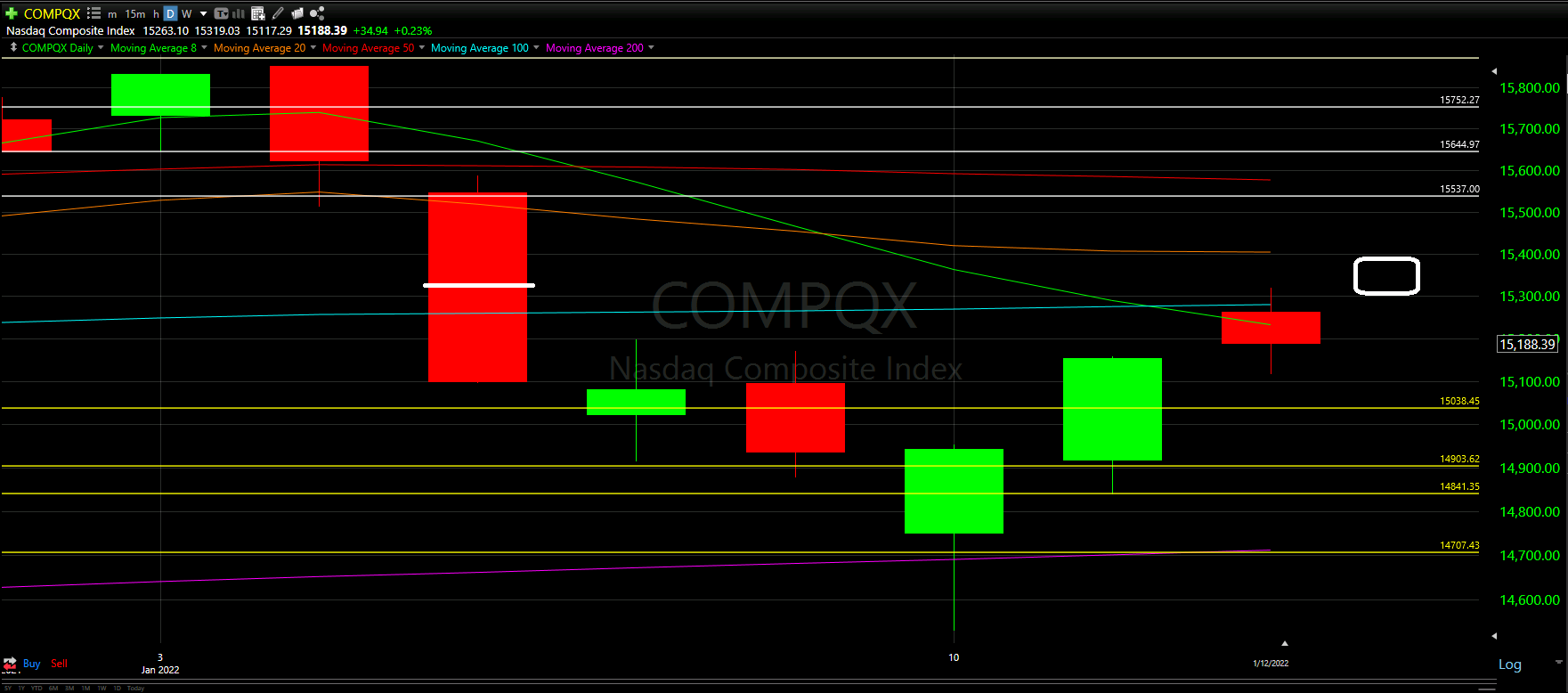

Hourly Analysis

Just as we saw with the S&P-500 Hourly Chart, the Moving Averages really came into play and guided the candles along the day.

We started with a positive first hour, staying well above the 20 Moving Average line in orange.

The second hour really took a lot of the steam out of the sails, dropping hard and closing below just mentioned 20 Moving Average line.

From there the 8 Moving Average line really guided most of the hours back up, actually surpassing the 20 Moving Average line once again.

However, by the end of the day we lost the 8 Moving Average but closed above the 20 Moving Average line. Obviously, we would have liked to seen both Moving Average lines under the candle.

Final Thoughts and Targets

Unfortunately, there was a fairly mixed bag of good and bad in the daily review. That makes it much harder to predict what tomorrow will do

The dreidel-looking candle as well as the lower-than-ideal RSI indicator does add a bit of hesitation. With the attempt to overtake the 8 Moving Average a failure today, maybe tomorrow will be the day we can get over this first cluster of moving averages.

Best case scenario, we continue this uptrend, overtake the 8 Moving Average and 20 Moving Average lines, and pretty much close around 50% of the big red candle from 6 days ago.

Worst case scenario, we lose this momentum and drop back down to the Support lines at the bottom

Here is hoping we curve upward!

Good luck trading!

Don’t forget to check out the Free Knowledge Center to refresh the basics or learn more about Technical or Fundamental Analysis