January 11th recap and 12th Predictions

What to Expect in the Analysis Below

With the seventh trading day of January completed, let us see how the day played out and what to expect tomorrow.

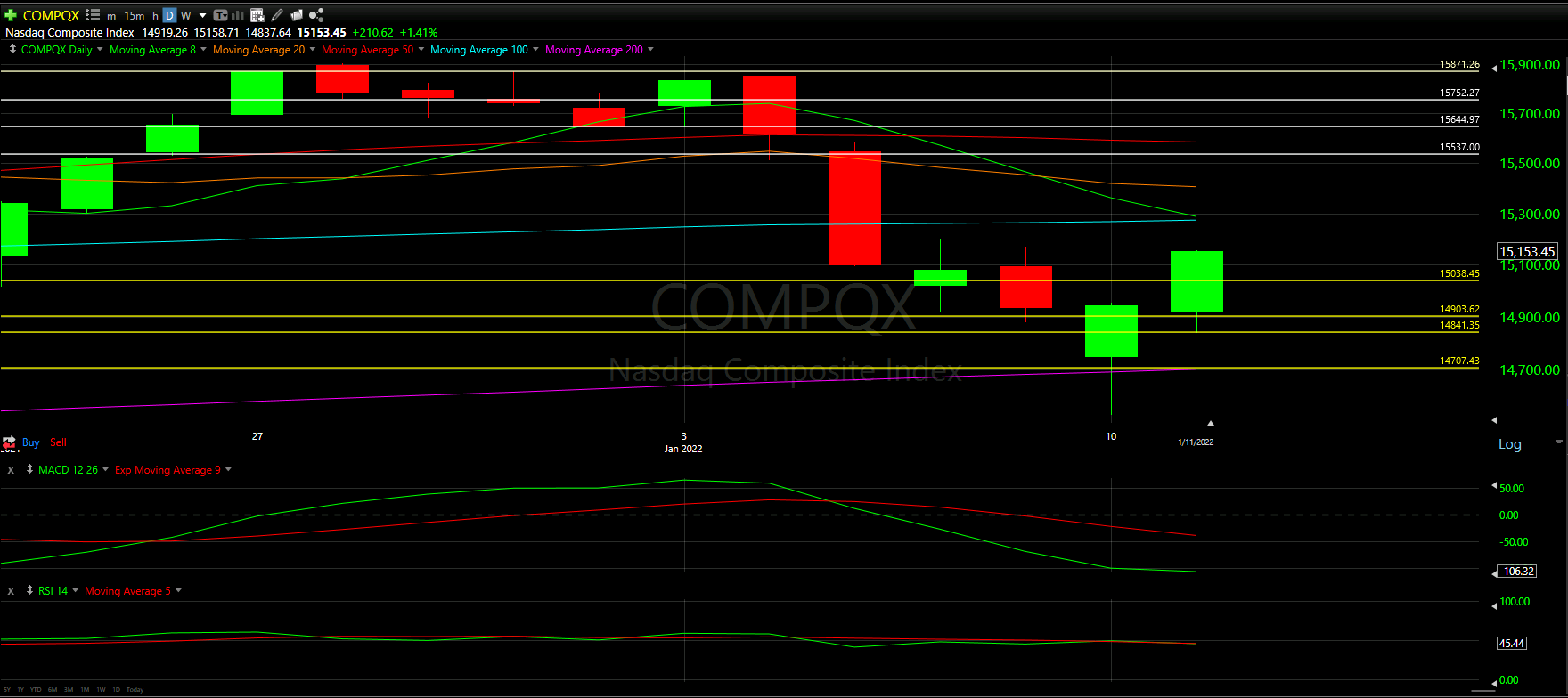

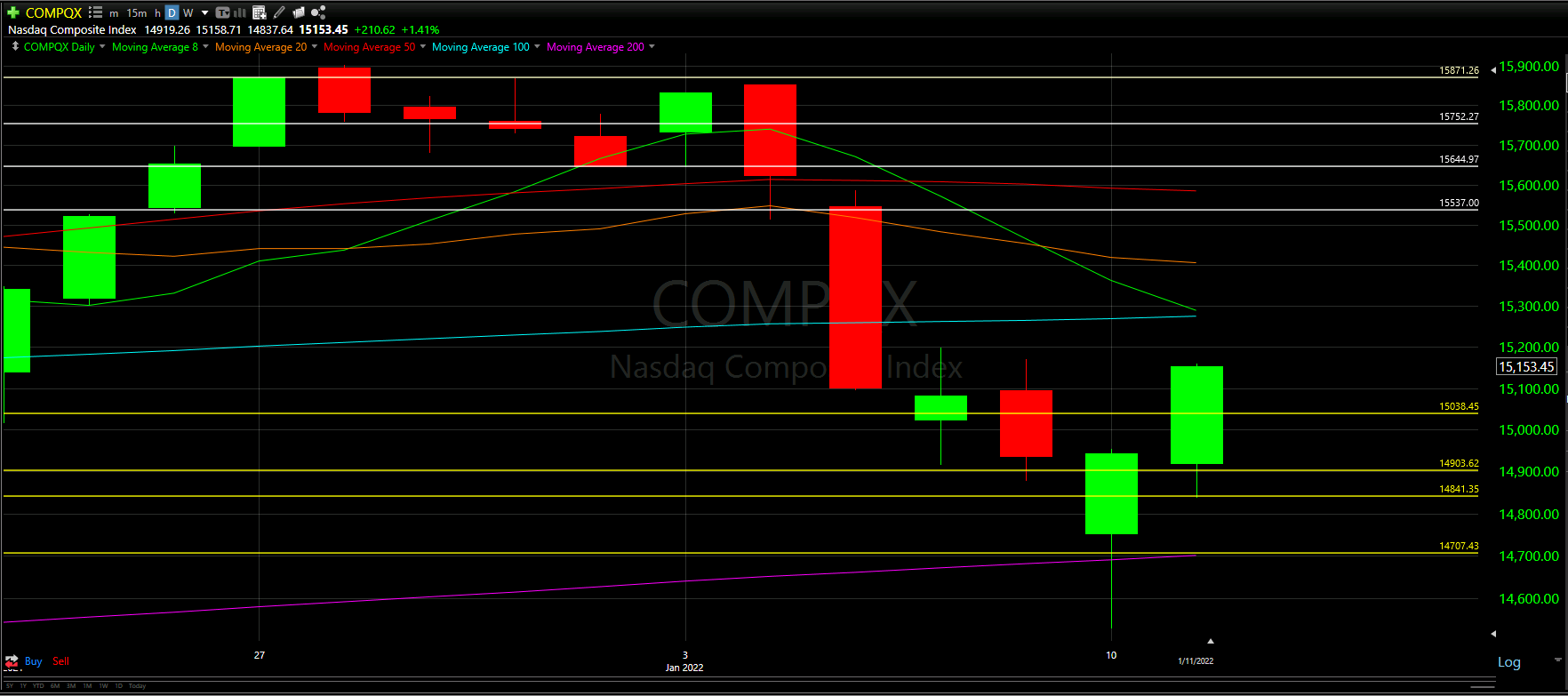

Above you will see the full view of the Daily chart; Top and Bottom indicators included.

As always, we will start by analyzing the Top Half of the Daily chart; seeing how our horizontal Support and Resistance Lines played out during the day, reviewing the Moving Averages that came into play as well as comparing previous candles

From there, we will analyze the Bottom Half of the Daily chart to see what the momentum looks like going into tomorrow with the additional MACD and RSI indicators.

Ultimately, we will use the combined data to help anticipate the movement of the NASDAQ for tomorrow.

Top Half Analysis

It is always good when there are correlations (or similarities) between the Major Markets. You will see that today’s Top Half Analysis of the Dow Jones was very similar to the NASDAQs

Yesterday we mentioned that it was the best day the NASDAQ has seen in over 10 days of trading, and today, we get an even better follow through!

There was a small wick at the bottom of the candle today, but nothing like yesterday - meaning it was pretty much a full day of positive trading.

Just like the Dow Jones, it appears we have broken the 5 day downtrend; however, we really need one more day to confirm the trend break.

We have now overtaken all the Support lines at the bottom of the chart above; ideally, the climb back to the top will start from here.

First things first, we really need to get over that big cluster of Moving Averages around the $15,300 - $15,400 range. Breaking above a single Moving Average is hard enough, but a cluster adds a bit more difficulty. Let us see how this plays out over the next days

We have not broken this downtrend yet; however, today was a much needed good day.

Bottom Half Analysis

Just as we saw with the Dow Jones, the MACD and RSI are showing contradictory information.

The MACD is starting to show signs of recovery with the Green line starting to potentially curl up. What matters is actually being over the Red line; however, we need to curl up before we can pass above. Ideally this is the start of a nice reversal.

Once again the RSI seems odd - the Green line is actually declining under the Red line even though we had back to back good days.

Will we lose the momentum based on the RSI or is the MACD the indicator to focus on since it is showing the curl? That is one of the hardest parts of technical analysis.

When you are unsure, the safest thing to do is be overly cautious!

Hourly Analysis

The NASDAQ hourly chart really is a thing of beauty!

The only negative hours look like minor specs on an otherwise green-heavy chart. That 3rd hour really hit the home run for the NASDAQ - almost an entire hour of strong trading.

Very little needs to be said about a chart like this; however, just note the 20 Moving Average combined with one of our yellow Support lines were a strong catalyst for the 3rd hour push

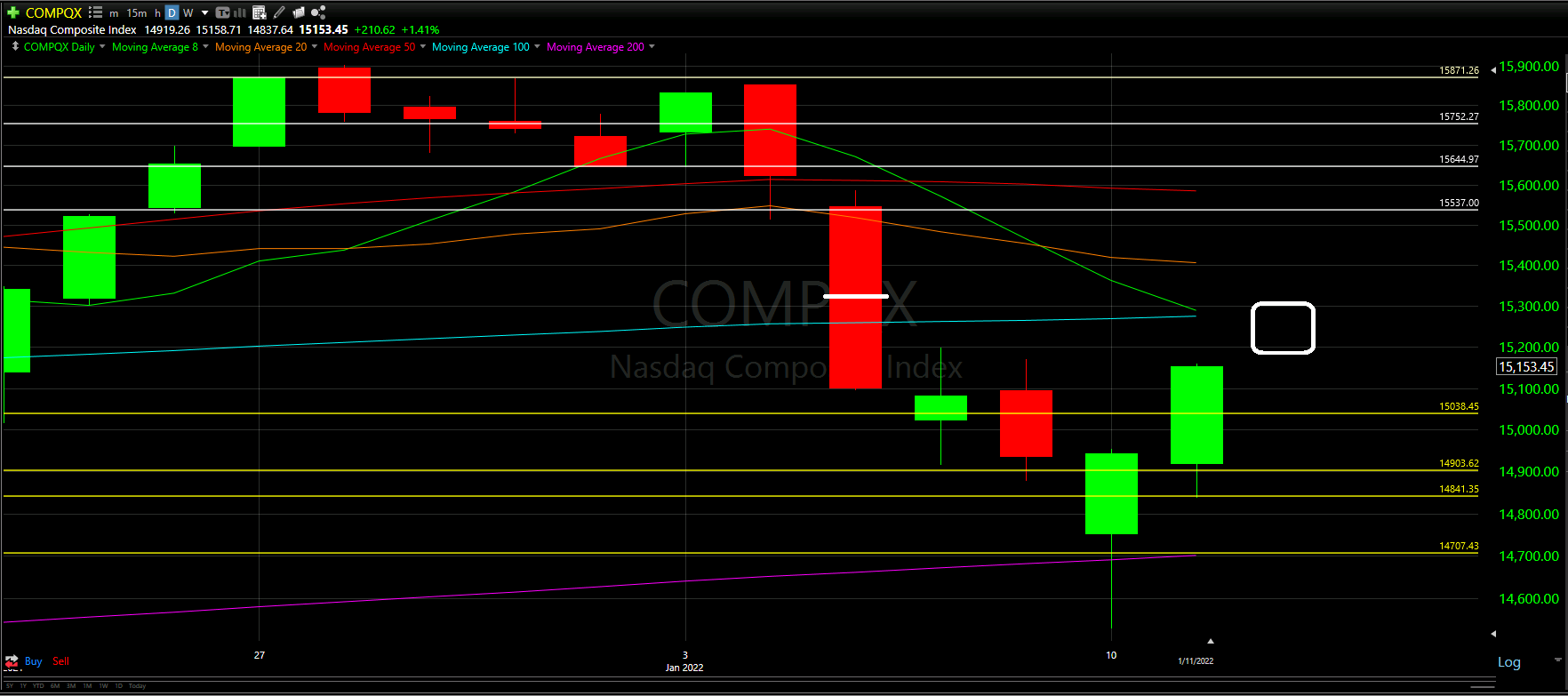

Final Thoughts and Targets

Just as we said for the Dow Jones, tomorrow will be a very telling day for the NASDAQ.

There is more optimism than fear in the Daily and Hourly chart analysis; however, the RSI indicator seemed to be a rather odd outlier.

If the day goes well, the goal will be to close at or above the 8 Moving Average line right around the white square above. Additionally, a small white line was drawn at roughly the 50% line of the huge red candle a few days ago. This will be a major hurdle to get over along with the cluster of Moving Averages

The worst thing that could happen is we lose more than 50% of today’s candle and continue a downtrend

Here is hoping we curve upward!

Good luck trading!

Don’t forget to check out the Free Knowledge Center to refresh the basics or learn more about Technical or Fundamental Analysis